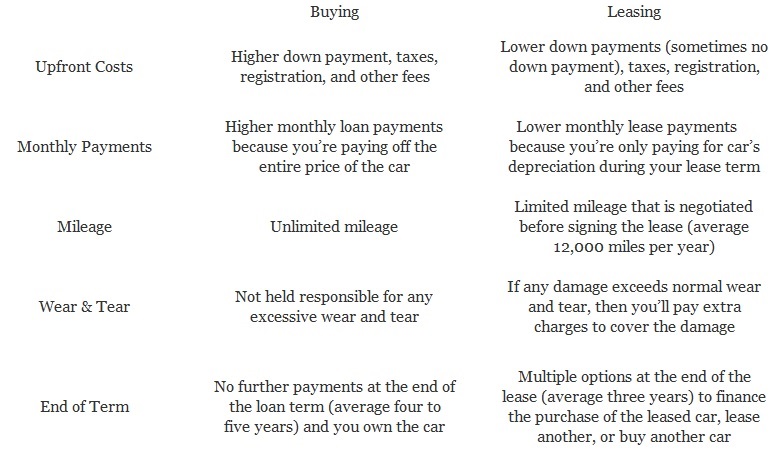

Purchasing a car is a sizeable financial decision that requires extensive thought and research. An alternative option to buying is leasing, but there are pros and cons to both choices. Understanding a car lease can by difficult and although the basic premise of a lease appears straight forward, there are many underlying complexities that can be deceiving to most people. Let’s dive into this debated topic in order to help you make a decision that’s best for you.

Leasing is just like renting; you pay each month to use the vehicle and do not own the car at the end of the contract. You’re obligated to fulfill your entire lease unless you’re willing to fork over a hefty early termination fee. Plus, you’re still required to perform necessary upkeep to the vehicle such as oil changes. These maintenance fees will usually be minimal during the length of your lease and most cars are still under warranties that cover major repairs. In addition to regular upkeep, you’re also held responsible for excessive wear and tear. At the end of your lease, if the dealership finds any damages that are more than normal wear, then you are responsible to pay extra charges.

The biggest limitation to any lease is the mileage cap. The average length of a car lease extends three years allowing 36,000 miles of driving throughout those years. If you exceed this mileage cap, there is a cost per mile for each mile you are over the limit. This cost is usually around 15 cents per mile. In most cases, you are able to arrange a lease with higher mileage with the dealership, but it will result in more expensive monthly payments.

Although many of these limitations may sound overwhelming, remember that you shouldn’t be afraid to negotiate! Contrary to what some people believe, leasing prices are not set in stone and are not the same at all dealerships. The key to understanding a car lease is shopping around and doing your research – SEE INSIDER TIP BELOW. This will give you the upper hand when negotiating, because the salesperson will know you have other (and possibly better) options. Approaching a lease using these tactics will help you get the best leasing option available.

INSIDER TIP: Shop for a Lease Based on Residual Value

- Residual value = the price at which you can buy the car at the end of the lease

- Residual value directly affects month payment cost

- Higher residual value = lower monthly payments

- Ultimately, lease a vehicle that holds its value

Although, leasing a car is the least expensive option in the short run with lower down payments and monthly costs, it is not the best choice for everyone. Consider your type of lifestyle when making this decision. For example, do you drive an hour to work every day or do you have young children that may damage the car’s interior? In these cases, leasing a vehicle may not be for you, but just remember to do your research and never be afraid to negotiate to ensure that you get the best deal possible. We’re a Johns Island Financial Advisor and are here to help you analyze your lifestyle and give you confidence in your financial decisions. Please contact us today to set up a complimentary appointment and we can discuss a plan of action that satisfies your needs!

Image Credit: Wikimedia