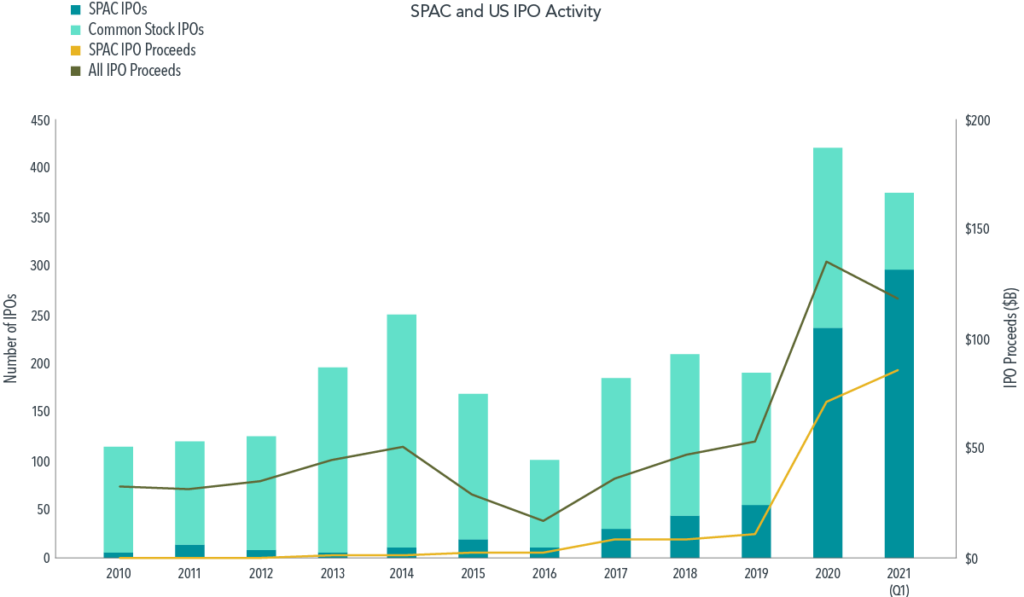

IPOs, SPACs, and Direct Listings

Investors are flooded with information, options, and little guidance when choosing what investment vehicles to put in their investment accounts. During and post-Pandemic, many of these options became household names as some investors worked from home and became quasi-day traders in their free time. The rise of popular MEME stocks via Reddit and access to […]

When Markets Drop

In the next couple of weeks, investors will begin receiving October portfolio statements from their custodians and may ask themselves what to do when markets drop. If you’re like most investors, you usually don’t take the time to check your account balances daily, online or through your mobile app, but rather only decide to look […]

Where is the Value Premium?

From 1928–2017 the value premium1 in the US had a positive annualized return of approximately 3.5%2. In seven of the last 10 calendar years, however, the value premium in the US has been negative. This has prompted some investors to wonder if such an extended period of underperformance may be cause for concern. But are […]

Tuning Out the Noise

For investors, it can be easy to feel overwhelmed by the relentless stream of news about markets. Being bombarded with data and news headlines presented as impactful to your financial well-being can evoke strong emotional responses from even the most experienced investors. News headlines from the ”lost decade”1 can help illustrate several periods that may […]

Bitcoin: A Prudent Investment?

To Bitcoin or Not to Bitcoin: What Should Investors Make of Bitcoin Mania? Bitcoin and other cryptocurrencies are receiving intense media coverage, prompting many investors to wonder whether these new types of electronic money deserve a place in their portfolios. Cryptocurrencies such as bitcoin emerged only in the past decade. Unlike traditional money, no paper […]